ADRF Finance Team

Mandate of the Finance department includes the following

- Capital Management:Secure and manage funding for growth and operations.

- Financial Planning & Analysis (FP&A):Forecasting, budgeting, and market trend analysis.

- Investment Evaluation:Assess and align opportunities with strategic goals.

- Risk Monitoring & Mitigation:Identify and reduce financial vulnerabilities.

- Compliance & Reporting:Meet all financial, tax, and regulatory obligations.

- Cost Optimization:Improve efficiency and reduce waste.

- Strategic Advisory:Guide leadership on financial aspects of M&A, expansion, and restructuring.

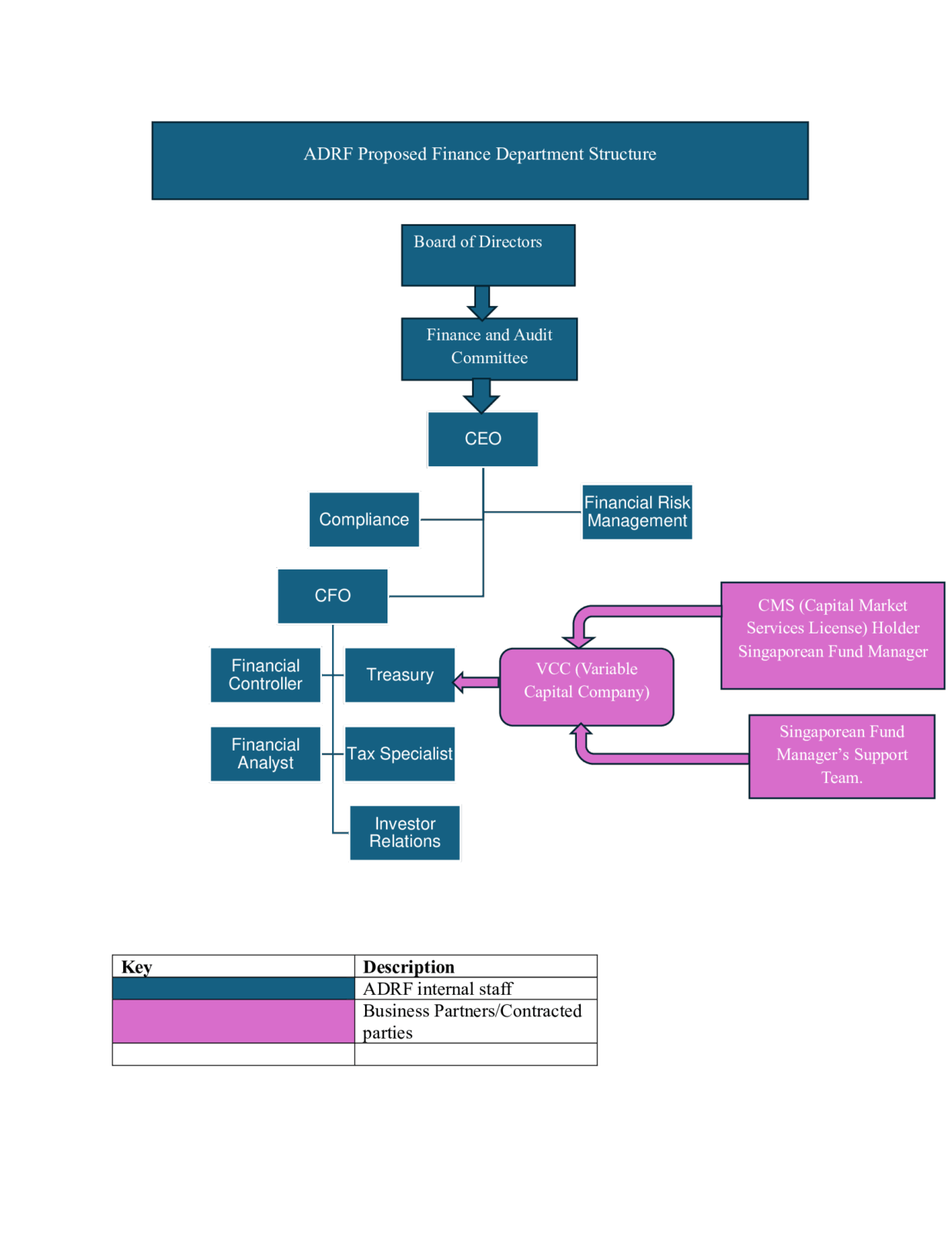

The ADRF finance structure brings together specialized roles under strategic leadership, enabling robust financial governance, risk management, and long-term value creation.

Achievement of the above mandate is faciliated through the structure below

- Chief Financial Officer (CFO)

- Leads the finance team; aligns financial operations with ADRF’s strategic goals.

- Advises the CEO and Board, reports to the Finance & Audit Committee.

- Key Duties:Financial strategy, compliance, investment evaluation, strategic financial advice.

- Treasury

- Manages liquidity, cash flow, and financial risk.

- Works closely with the Singaporean Fund Manager and his team who will do our investments under the VCC (Variable Capital Company). The Manager will possess a CMS (Capital Market Services Licenses) as required by the MAS (Monetary Authority of Singapore) .

- Key Duties:Cash management, banking and investor relations, hedging and risk strategies.

- Financial Controller

- Oversee accounting operations and ensures accurate reporting.

- Key Duties:Financial statements, audits, budgeting, accounting compliance.

- Financial Analysts

- Provide data-driven insights to support financial decisions.

- Key Duties:Data analysis, forecasting, investment assessment, reporting.

- Tax Specialists

- Ensure tax compliance and optimize tax planning.

- Key Duties:Tax returns, strategy, compliance monitoring, audit risk mitigation.

- Financial Risk Management Specialists

- Identify and mitigate financial risks affecting operations.

- Key Duties:Risk assessment, exposure minimization, regulatory compliance.

- Investor Relations Manager

- Manage communication between ADRF and investors/shareholders.

- Key Duties:Performance updates, shareholder engagement, investor materials.